Content

- How Investing In Technology Can Take Small Businesses To The Next Level?

- Upgrade Your Blockchain Skills With 101 Blockchains

- How To Avoid Getting Rekt In Defi?

- How Customers Access Liquidity

- How To Find Best Liquidity Provider

- Types Of Liquidity Providers

- Real Examples Of Decentralized Finance Liquid Market Financial Institutions

The term «liquidity» broke into the crypto industry from the world of traditional financial markets such as Forex, stocks, and CFDs. Liquidity providers should be regulated in the same way as brokers to ensure they are operating under the industry’s best practices and that there is a prime broker backing up the liquidity provider. In order to source the best liquidity provider, brokers need assess their own specific needs and make an informed choice based on a number of factors. The protocol is a standard protocol that allows you to place orders, send cancellation requests, and receive the required data. The use of messages in the FIX protocol format is probably the most efficient way of communication between an exchange and its liquidity provider.

A liquidity provider is an indispensable element in the liquid market that can provide greater price stability, without which currency volatility would have reached enormous values. On the other hand, these financial organizations that continually provide liquidity are not aimed at helping in trade but rely solely on their own profits. Conditions should be clear and transparent so that brokerage businesses could face no hidden payments or fees. The overall value of a liquidity pool and the circulating quantity of total LP tokens are the two factors that define the value of an LP token. The pool’s overall worth is the sum of its crypto assets’ market values. The main role of a liquidity provider is to act as a market maker, increasing the transaction volume and lowering volatility in the markets.

All Your Uniswap v3 Liquidity Farming Calculations Are Dead Wrong! Here’s Why – Cryptopolitan

All Your Uniswap v3 Liquidity Farming Calculations Are Dead Wrong! Here’s Why.

Posted: Fri, 16 Sep 2022 07:00:00 GMT [source]

High liquidity in the marketplace is an ideal situation as it makes for improved prices for all concerned due to the large number of buyers and sellers in the marketplace. A buoyant marketplace with a high level of trading activity tends to create an equilibrium market price that is acceptable for all. In all cases you should check the Ts&Cs offered by the liquidity provider prior to signing up. To give an example, if you are looking to launch your own MT4/MT5 white label, you should confirm that the liquidity provider in question can cater for this requirement. Similarly, if you are looking to offer money management services, it is important to find out whether they can also offer liquidity for this type of service.

If you are looking for some of the best certification courses in the blockchain industry then Blockchain Council is available at your services. The blockchain courses offered at Blockchain Council are designed in such a way that along with theoretical knowledge it provides the candidates with in-field training and certification. You need to simply enroll in the course that best meets your expectations.

How Investing In Technology Can Take Small Businesses To The Next Level?

Liquidity providers are financial institutions such as banks, mutual funds and hedge funds, private companies, large investors, and sometimes brokers themselves. LPs are so-called third parties that connect brokers/exchanges and market makers . The direct interaction is impossible, as market makers deal with large trades only, and brokers cannot fulfill the required conditions. When someone stakes LP tokens for yields, they are putting their faith in the DeFi network and its smart contracts.

This means that even though certain markets may close around the world and liquidity fluctuates, there are usually relatively high volumes of Forex trading going on all the time. When trading in Forex the term liquidity is frequently thrown around. Access to liquidity and the function of a liquidity provider and that of a liquidity broker are often confused. For as basic as they may sound it is important to clarify terms so that you can be more familiar with the characteristics of these market concepts and the benefits they may offer. FIA’s digital news service offers timely intelligence on business, technology and regulatory trends affecting the cleared derivatives industry around the world.

Upgrade Your Blockchain Skills With 101 Blockchains

Developed by industry professionals, FIA Training helps market participants better understand the way markets work and the rules that protect them. FIA maintains a central repository of exchange-provided risk controls and practices in global cleared derivatives markets for the exclusive use of FIA members. Let’s find out what a liquidity provider is and what to consider when choosing a reliable liquidity provider. As a result, several sell/buy orders for different trading pairs drop into the order book, allowing traders to execute their orders at specified prices instantly.

- If more people trade the EUR/USD currency pair and at higher volumes than the YEN/USD, it means the first has more liquidity than the second.

- This platform allows users to create pools of liquidity with eight different tokens in any ratio.

- Our article will provide a full rundown of crypto liquidity providers and cover how to choose the best crypto liquidity provider to aid your technology and crypto business in growing.

- When a broker understands how liquidity provider works, it’s high time to apply to reliable companies, getting a jumpstart on the market.

- Liquidity providers are some kinds of players who are behind the scenes of the crypto market, but nevertheless, they are irreplaceable.

- On the Finarm website, you will find reliable liquidity providers, market makers, and information on their key services.

This is done by providing more assets and ensuring an uninterrupted flow between demand and supply. In return for providing liquidity to a market, the LP is offered a return on investment. Without LPs, trades could not occur, so, as LPs are facilitating trades, they are rewarded with a percentage of the transaction fees. The amount that a LP is rewarded depends on the percentage of the liquidity pool that they provide. Liquidity is a concept that is important to understand when dealing with cryptocurrencies.

There are several factors that determine the level of liquidity for any cryptocurrency coin. More importantly, it also ensures stable market prices, without large differences in short periods of time. When prices are stable enough, the market can endure large orders without significant spikes or changes. In this case, brokers can offer fast and smooth execution for greater numbers of clients and for larger orders.

How To Avoid Getting Rekt In Defi?

What are the players who maintain the market active, stimulating deals be executed instantly? World’s largest banks, hedge funds, and other giant institutions manage billions of dollars and other currencies, making it possible for other players to exchange currencies in seconds. Search by either token or by the protocol for yield farming opportunities applicable to you. If using a cryptocurrency other than ETH, Zapper.fi may require you to approve a spending limit for the first deposit. Staking a token in Ethereum basically meant that you couldn’t use it for other purposes. All of these strategies contribute to liquidity in our markets, which is a topic we’ll explore in greater detail in our next blog.

Moreover, new companies entering the market face serious competition. And it is important to offer potential clients the maximum list of benefits. Cooperation with the best liquidity Forex provider allows you to achieve success and make your company successful. Let’s talk about who liquidity providers are, why they are needed and why their activities are so important for an ordinary trader.

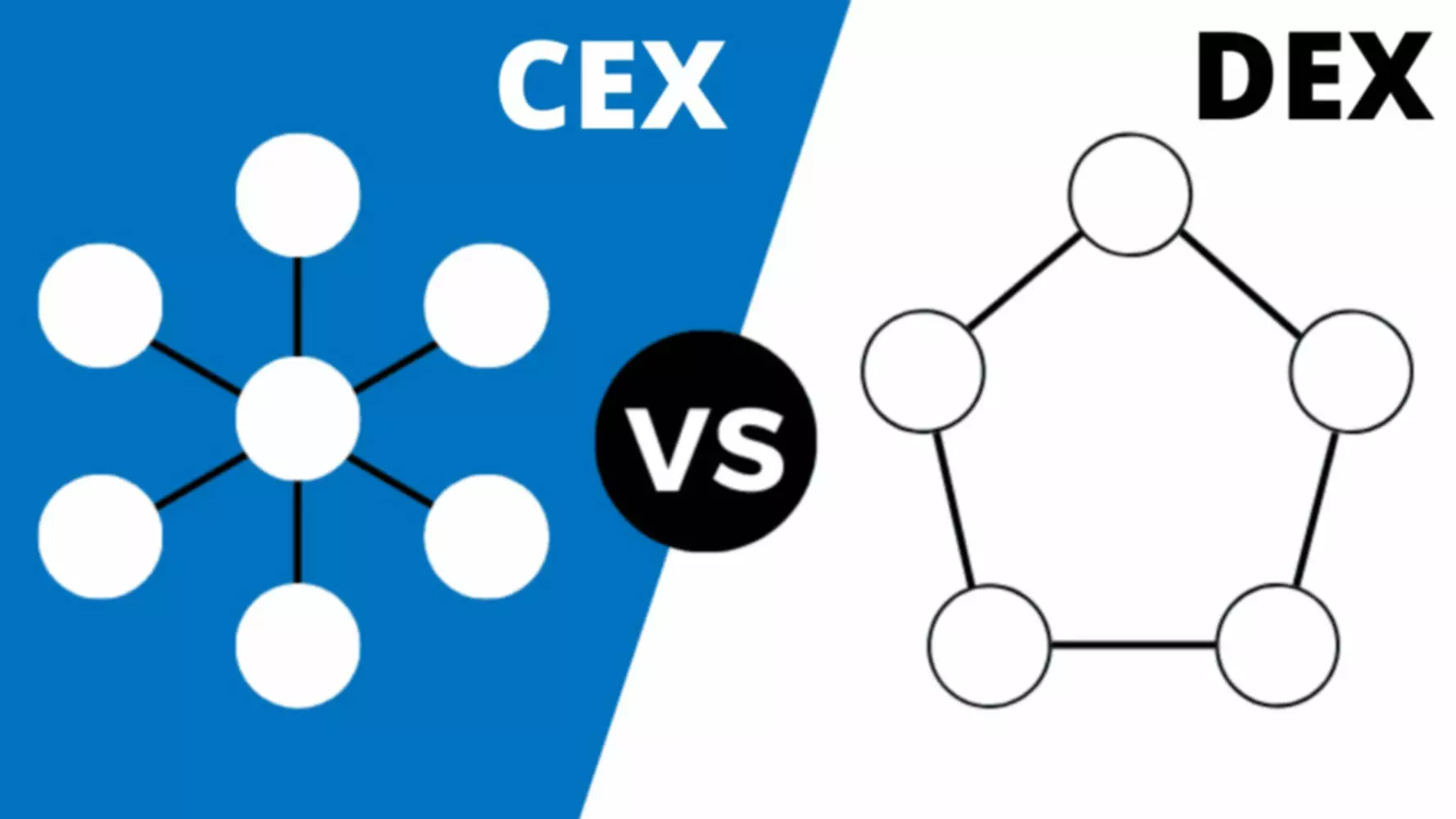

This is a decentralized exchange, a customizable DEX structure, and a robotic index fund. This is a trading platform that crypto investors use to provide and receive loans in digital assets. Since the beginning of 2021, Compound has returned to its investors more than 100% of their invested funds. Providing liquidity on DEX is one of the most popular trends in the world of decentralized finance.

They are traded in dozens of markets, and as well as cash and futures products, they are available for commodities such as gold and oil, stocks and indices. Easily find liquidity provider partners and suppliers through a convenient filter search. Apexum is an expert in integrating brokerage solutions that include a full set of services aimed at successful brokerage creation.

How Customers Access Liquidity

The execution system should be detailed especially during the market data releases and unexpected events such as SNB. You should be able to easily check the trade execution using an automated trading software or app that can allow you to build detailed statistics. Liquidity in Forex is used to describe the level of activity taking place in the financial market.

The most popular decentralized exchange is Uniswap, with over $7 billion in total value locked in the protocol at the time of writing. Uniswap leverages liquidity pools with an automated market maker to offer instant cryptocurrency exchanges. How liquidity provider tokens work by taking note of the fact that you are in control. Liquidity providers get the LP tokens in return for providing assets in the liquidity pools and staying in control of their tokens. It is also important to note that an autonomous code supports the management of the liquidity pool. Without any manual intervention, the liquidity pools provide the assurance of fairness.

How To Find Best Liquidity Provider

LP tokens show how much you have put in a pool, and the code would decide how much you should get from transaction fees for your contributions. Learn more about DeFi and liquidity provider tokens in detail clearly right now. Diversified instruments Nowadays it is essential for a broker liquidity provider to have multi-asset liquidity and a deep order book. The list of market tools should include FX , bonds, equities , equities CFDs with leverage commodities , cash indices as well as futures indices, bullions , and ETFs. A liquidity provider should present to you a complete order book via trading platform and via FIX protocol, where you can have access to historical tick data of each level of the order book. A broker liquidity provider Forex should be an institution or individual above suspicion in order to meet the highest standards.

Hence, being able to add internal liquidity to the exchange liquidity is important in providing a high level of service to partners. Retail investors cannot directly access exchange transactions of Tier 1 liquidity providers, i.e., banks and other financial institutions. They will need different products on different business models that brokerage companies provide. Liquidity providers utilize a strategy known as liquidity mining or market-making to stake their currencies on decentralized exchanges in order to receive transaction fees. Based on the number of transactions and the amount of liquidity put into the pool, an accurate projection of your expected return may be generated. Now, the liquidity providers can exercise their claim over shares in fees for transactions in the liquidity pool.

BTC has become the most liquid crypto asset since it is accepted and traded on almost every central exchange. Because it is the initial asset and is accepted and exchanged on every decentralised exchange, Ether is the most liquid currency in the DeFi ecosystem. As DeFi is built on the Ethereum network, Ether again becomes highly liquid and it is accepted and exchanged on all DEXs. LP tokens aren’t very distinct from other tokens on the same network in terms of technological qualities. For example, Uniswap and Sushiswap are both Ethereum-based platforms, and their LP tokens are ERC20 tokens. These LP tokens may be transferred, sold, and staked on other protocols just like any other ERC20 token.

A short glance at CoinMarketCap or any other coin ranking website will show you the daily volume of each coin on the market. The trading volume indicates the number of people buying and selling the coin and the sizes of their positions, making it a key factor in deciding the coin’s level of crypto liquidity. This can be done on your own, but you will have to spend a lot of effort and resources. Accordingly, there will be no time left for the development of the exchange itself or the exchange service. That is why it is recommended to use the services of liquidity providers.

Types Of Liquidity Providers

Cash is the most liquid asset in conventional finance since it can be exchanged for a variety of assets in a short amount of time, such as gold, stocks, bonds, and more. The process of changing fiat money to cryptocurrency is more complicated than it appears. Most DeFi liquidity pools allow liquidity providers to redeem their Liquidity Provider Tokens for cash at any time, albeit there may be a small cost if they do so too soon. A traditional order book exchange working with liquidity pools is extremely inefficient on smart contracts.

The services that a liquidity provider offers is one of the main aspects to look at because as we have seen, they all differ. The growing trend for the trading of assets means that brokers need to have access to a good liquidity provider. There are many such companies that brokers can approach but What is Crypto Liquidity finding the best one to work with is not always clear-cut. Irrespective of their names across different platforms, LP tokens serve as mathematical proof of your contributions to a liquidity pool. Now, you should also take note of another interesting term in the DeFi space, i.e., yield farming.

When the market is liquid, buying and selling cryptocurrencies is easier for the trader, since there are higher volumes of trading activity, so orders can be executed more quickly. Since the Crypto market is one of the most hectic markets available today, when liquidity is high it means that traders enter a position or exit at any point. If you are opening a crypto brokerage or thinking of adding cryptocurrencies to your offering of tradable assets, you are going to need crypto liquidity for it. In this article, we explain how it works and how to get the best option for your business.

Real Examples Of Decentralized Finance Liquid Market Financial Institutions

Rewards can come as a share of the transaction fees or additional cryptocurrency tokens. The biggest liquidity providers in the forex market are usually prime brokerages, large banks, and other financial institutions. One of the first things to consider is the trading products you will be offering your clients before selecting a https://xcritical.com/ liquidity provider. It is wise to choose a multi-asset provider who is able to handle every kind of liquidity requirement. Depending on the type of brokerage you operate, you need to ensure that both Forex, and other trading products such as stocks, oil and metals are covered so that you find the ideal company to partner with.

After all, the high liquidity of trading pairs is a direct way to the success of the project and attract new investors. You need to be absolutely sure that the instruments, like the transactions themselves, are not burdened with swaps. This point requires special care since there are not many liquidity providers in the world of cryptocurrencies offering their own trading technologies and bots.